Personal Income Tax Rates for Residents

The personal income tax system for Tax Residents in Singapore is based on a progressive tax system. This means that a different tax rate is charged progressively as income increases. Simply put, your annual personal income will be divided into different income bands with a progressive tax rate attached to the next band. The highest personal income tax rate is currently fixed at 20% (which is 3% higher than the current headline corporate tax rate).

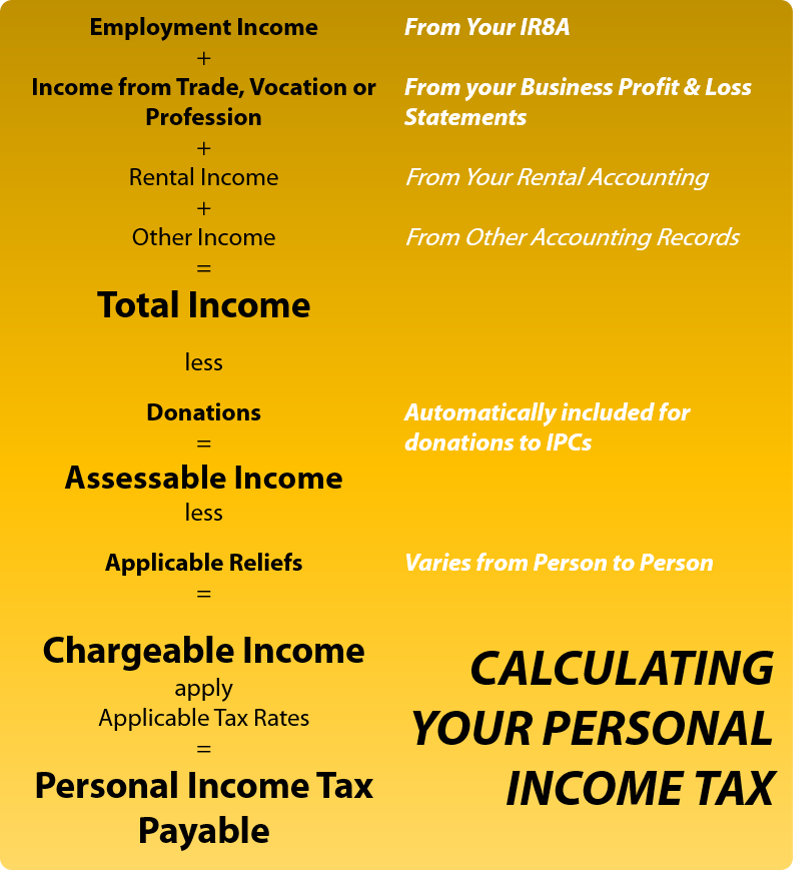

Systemic Flow of Personal Income Tax Computation

Components of Personal Income Tax Computation

| Employment Income | This refers to the aggregation of your employment remuneration which can be found in the IR8A given to you by your company. |

| Income from Your Trade, Vocation or Profession | This refers to income from your sole proprietorship business and/or partnership share of profits. |

| Donations | Donations made to approved Institute of Public Characters (IPC) will be automatically reflected in your returns |

| Reliefs | Reliefs are granted depending on your eligibility for each of them. Reliefs available include:

|

Personal Income Tax Filings are done once a year, and are based entirely on income accrued in a full calendar incepting 1 January and ending 31 December, both dates inclusive, for every year.