THE PRIVATE LIMITED COMPANY – PART I: AN INTRODUCTION TO THE COMPONENTS AND PEOPLE OF THE COMPANY

In this section, you will learn about what are the key components and people of a Private Limited Company. You will appreciate and understand:

- The concept of a Private Limited Company

- The basic requirements of forming a Private Limited Company

- The respective roles, responsibilities and rights of the Directors and Shareholders

- The statutory and constitutional framework that the Company operates from within

What is a Private Limited Company?

A private limited company is a legal entity formed by the founding shareholders for the (usually the case) purpose of generating business profits. The company has a separate identity from its owners and directors, thus acquiring the ability to sue and be sued in its own name and has the legal rights to own properties under its name. The company is perpetual and will exist so long as the owners wish for it to remain in existence. Succession is possible with existing and new owners being allowed to enter or exit the company through injection of shares or transfer of shares.

What is the essence of the word Limited?

The “Limited” refers to the limitation of liabilities of the shareholders towards the Company. This limitation basically refers to the extent of the amount owing from the shareholders to the Company, in respect of the unpaid portion of their shareholdings in the company. This means that if a shareholder has fully paid up his portion of shares, he will be freed of any obligations or liabilities towards the Company.

The idea that the Company has limited liabilities towards its creditors is incorrect. The Company still potentially has unlimited liabilities towards its creditors. The feature to appreciate is that in most circumstances, even if the company is unable to pay up its outstanding liabilities to its creditors, the creditors has no rights to call for the personal assets of the owners to balance the deficit, and this is what is uniquely special and advantageous for business owners when opting for a Private Limited Company over other forms of business entities. The owners’ personal assets are protected from business risks and failures.

Please do note that the protective mechanism will not work if the shareholders sign personal indemnities with the creditors (example, acting as personal guarantor for a company bank loan), or if the court decides to lift the corporate veil if circumstances point towards a need to do so.

Lifting the corporate veil refers to the legal decision to treat the rights and obligations of a company as though they are the rights and obligations of the shareholders. This usually occurs in exceptional scenarios whereby the owners hide under the guise of a company to avoid an existing legal duty or obligation, to perpetrate fraud, to act as the agent or partner of the controller or any other situations as the courts deem fit.

Forms of Limited Company

THERE ARE ESSENTIALLY 4 MAIN FORM OF A LIMITED COMPANY:

- Small Companies Read More

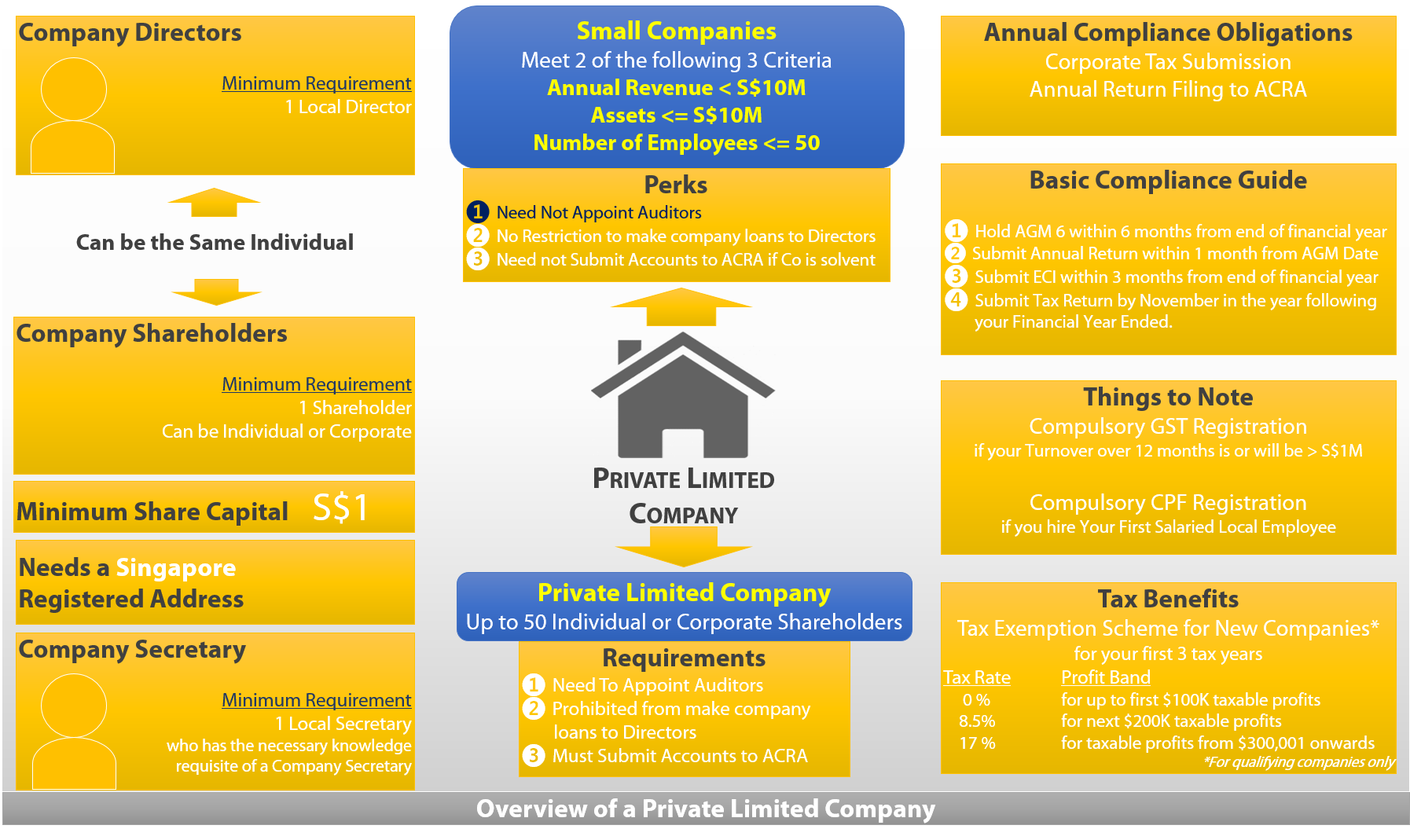

(Most common form of company startup) With effect from 1 July 2015, a new small company concept was introduced for exemption from statutory audit of the company accounts. A Private Company qualifies as a Small Company if it is a private company in the financial year in question; and it meets at least 2 of the following 3 criteria for the immediate past two financial years:

(i) total annual revenue ≤ $10m;

(ii) total assets ≤ $10m;

(iii) no. of employees ≤ 50.

Where a company has qualified as a small company, it shall continue to be a small company for subsequent financial years until it is disqualified. A small company is disqualified if it ceases to be a private company at any time during a financial year; or it does not meet at least 2 of the 3 the quantitative criteria for the immediate past two consecutive financial years. The company needs to appoint a company secretary to complete the company officer set-up. - Private Limited Company

A company incorporated in Singapore that has less than 50 shareholders and shareholders can be either individuals or corporate entities (LLP or corporations). The company needs to appoint a company secretary and an auditor to complete the company officer set-up. - Public Company Limited by Guarantee

A public company limited by guarantee is one which carries out non-profit making activities that have some basis of national or public interest, such as for promoting art, or charity etc. Typically, the setup process will require an approval in principal from the relevant government agency depending on the type of non-profit making activities you intend to carry out, before the actual incorporation. The Minister may approve the registration of the company without the addition of the word “Limited” or “Berhad” to the name of this type of Company. - Public Company Limited by Shares

A public company limited by shares is a company incorporated in Singapore in which the number of shareholders can be more than 50. The company can raise capital by offering shares/debentures to the general public. A public company must register a prospectus with the Monetary Authority of Singapore (“MAS”) before making any public offer of shares and debentures. This form of Company is the most regulated and complexform of Company set-up and requires significant investment on corporate and compliance infrastructure to meet with the existing regulations mandated by the Authorities.

Singapore Company Registration

A company is incorporated under the Companies Act of Singapore. The registration is considered completed upon successful lodgement with the Registrar of Companies and the Company immediately becomes “Live” on registration completion.

Registration Time Frame A Private Limited Company can usually be formed within 1 business day. In some instances, where the selected nature of business requires additional approval from referral authorities, or due to a random approval check, the days to completion for registration can range from 1 to 14 business days.

Summary of Information that you will need for Company Registration Prior to the actual registration, you will need the following information:

- Company Name

- Nature of Business

- Registered Address of the Company

- Share Capital Information (Number of Shares at $X per ordinary share)

- Particulars of Directors

- Particulars of Shareholders

- Shares Allocation to Shareholders

Company Name

Your Company name is usually suffixed by PTE. LTD. or Private Limited amongst some of the pre-defined suffixes availed to you by the Registrar of Companies. The name chosen for your company must not be identical or similar to existing companies and businesses, and must not be undesirable in nature.

Nature of Business

In older days, the Memorandum requires object clauses to clearly define the trade and business activities that the Company can operate in. In recent times, object clauses have been made non-mandatory, leaving the Company to be free to do any business activities so long as the Company has obtained the relevant and applicable business approvals, permits and/or licenses. Since 2016, the Memorandum and Articles of Association of a company has been renamed as Constitution of a Company.

The type of business activities assigned to the Company are categorically classified in the Singapore Standard Industrial Classification (SSIC) 2010, which is the tenth edition of such business classification administered by the Department of Statistics Singapore.

Registered Address

Every Singapore Company is required to have a valid Singapore Address with postal code. A PO box address is not considered a valid registered address.

A registered address need not be the actual business venue of the Company. However, you will need to know that specific letters will only be delivered to the registered address of a Company. For example, mails from government agencies like IRAS, will send tax forms and tax notices to the registered address of a company. Likewise, legal letters will be typically forwarded to residential address of the company directors as well as the registered address of the Company.

Directors

All companies are required to have officers. Directors are officers of the company that manages or directs the business of the Company. The broad guidance for the basic duty of a Director is enshrined in Section 157 of the Companies Act, which states that a director shall at all times act honestly and use reasonable diligence in the discharge of the duties of his office.Who can be Directors? Every Company needs to appoint at least one director who is ordinarily resident in Singapore. An ordinarily resident in Singapore. If the company only has one director, that director must be an ordinarily resident in Singapore.

An ordinarily resident in Singapore refers to a Singapore citizen, a Singapore Permanent Resident or a person who has been issued an Employment Pass/Approval-In-Principle letter/Dependent’s Pass and has his or her primary residency in Singapore (We will typically refer to this person a local director).

A foreign individual can also be appointed as a director of a Company so long as the Company has a local director.

Corporate directors are not allowed in Singapore as the Companies Act stipulated that a director must be a natural person, aged 18 and above and is of a sound mind.

Directors’ Transactions of Business If a company only has a single director, relevant business and statutory decisions requiring directors’ resolutions can be made and approved by the single director alone.

If a company has 2 or more directors, the quorum (minimum number of directors required to make a decision) is commonly fixed at 2. This implies that no transaction of business of the directors can be done without at least 2 directors present. For Director’s Resolutions, a simple majority is needed for decisions to be passed.

The quorum, although commonly fixed at 2, can be amended by the directors.

Key Duties and Competencies of a Director include:

- Discharging of responsibilities in the company;

- Possess a reasonable degree of skill and knowledge to handle the affairs of the company;

- Act honestly and be reasonably diligent in discharging his/her duties and act in the interest of the company

without putting himself/herself in a position of conflict of interest; - Employs the powers and assets that he/she is entrusted with for the proper purposes of the company and

not for any collateral purpose; - Ensure that the company comply with all the requirements and obligations under the Act including those in

of meetings, requisitions, resolutions, accounts, reports, statements, records and other documents on the company, filing and notices and any other prerequisites; and - Report to the shareholders for his/her conduct of the affairs of the company and make such disclosures that

are incumbent upon him/her under the Act.

Some common responsibilities that a Director is required to fulfill in accordance to the Act include:

- Appointing qualified persons as secretaries [S171]

- Ensuring that company registers or statutory books are kept and up-dated [S136, S164, S173, S190]

- Calling for Annual General Meetings, and convening of meetings [S175]

- Ensuring the lodgement of certain resolutions and agreements [S186]

- Preparing and lodging the Annual Return with ACRA [S197]

- Maintaining of proper accounting records [S199]

- Submission of accounts, balance sheet and directors’ report to shareholders at the Annual General Meeting

[S201]

- Ensuring that dividends are only paid out of profits [S403]

- Appointing of first auditors (for non-exempt private companies) [S205]

Resignation of Director Subject to any clauses stated in the Articles of Association of the Company or any employment contracts in place, an existing director can resign as director of a company by submitting a notice of resignation to the company, so long as the director is not the only local director left in the company.

Removal of Directors The provision to remove directors for private limited company is usually found in the Articles of Association, and not in the Companies Act. The usual Article of Association will often state that the company may by ordinary resolution remove any director before the expiration of his period of office. This decision is to be taken by the shareholders of the company.

Share Capital

Every private limited company needs to have share capital on incorporation. Share capital, is essentially, seed funds that the originating shareholders commit to the Company at its birth, in theory, to finance the business startup activities of the Company. Share capital is represented by number of shares. On incorporation, originating shareholders will subscribe to a certain number of shares at $X dollar issue price per share. The total value of share capital will be the summation of the issued value share amounts to each originating shareholder.

HISTORY LESSON ON SHARES

In many countries, the concept of par value and authorized capital and share premium/share discount still exists. However, in Singapore, these concepts no longer exist. In simple terms, you have issue 1 share at $1 last week when you set up your company, and today, you have decided to increase your share capital by further allotting 1 more share at $10,000 per share. Based on current regulation, you need not take into consideration any par (or base value) of each share. Your company capital is now simply 2 shares amounting to a total of $10,001. What is even more efficient and convenient for capital raising is that with no concept of authorized capital, there is no limit cap on the amount of capital the Company is allowed to raise (although previously the authorized capital limit can be freely raised with approvals from the Board).

COMPONENTS OF SHARE CAPITAL

Share capital can consist of issued, paid up or unpaid share capital. Issued share capital refers to the aggregate value of the shares issued to shareholders. Paid up share capital refers to the portion that has been paid up by theshareholders to the company, whereas unpaid share capital refers to the amount of share capital owed by the shareholders to the Company.

IMPORTANT NOTE FOR UNPAID SHARES

Subject to any clauses set out in the Articles of the Company, the Directors and/or the Company can make calls to ask the shareholders owing such monies to pay up the outstanding unpaid capital.

TYPES OF SHARES

In most cases, shares are classed as ordinary shares. Ordinary shares usually carry voting rights which means that holders of ordinary shares can have a say in certain company matters. Holders of ordinary share are also entitled to dividends declared from the profits of the company.

Do note that every company must have at least $1 ordinary share capital.

The other form of shares are termed preference shares. Preference shares are shares with certain preferential rights over ordinary shares. The preferential terms are usually in the form of dividend distributions, for instance a higher rate of dividend return compared to the dividend rate declared for ordinary shareholders.

In most cases, preferential shares carry NO voting rights, meaning that holders of such shares will not have a say in the decision making process.

IMPORTANT NOTE FOR PREFERENTIAL SHARES

In the event that preferential shares are to be allotted to existing or new shareholders, the specific rights or benefits attached to the class of preferential shares must be stated in the Constitution of the Company. Clauses relating to whether the preference shares carry voting rights, stipulated dividend rates if any, or whether the dividends are cumulative or non-cumulative, and right to participate in the company’s surplus and asset distribution, and/or any specific preferential terms must be set out in the Constitution of the Company.

SHARE CAPITAL INCREMENT

When the company is desirous of obtaining new capital from its existing shareholders or incoming investors, a share increment, or more commonly called share allotment, can be done by the company. Share Allotments will result in an increase in total issued share capital, and may affect the existing proportion of shareholdings for each of the existing shareholders.

SHARE TRANSFER

A person can become a shareholder by accepting the transfer of shares from an existing shareholder, based on an agreed transfer price. This arrangement will not affect the amount of issued capital in the company, however, the relative proportion of shareholdings for each of the shareholders may change. For instance, a share transfer from Shareholder A to Shareholder B may result in Shareholder B having the majority shareholdings and thus more voting power at general meetings of the company.

Directors may have powers to refuse any share transfers between the transferor and the transferee. The powers vested in Directors (including Directors who are not shareholders) in relation to their influence on share transfer are set out in the Articles of the Company.

SHARE REDUCTION

In a nutshell, the process for share allotment (increment) is relatively simple compared to share reduction. Share Reduction for a Private Limited Company is a tedious process requiring either getting a Court to approve the special resolution to reduce their share capital under S78G of the Companies Act (Cap 50), or an alternative procedure under S78B which involving the preparation of solvency statements, notification made to Comptroller of Income Tax andpublicity requirements which need to be carried out in accordance to the Companies Act and Regulation 6 of the Companies Regulations.

Shareholders

All companies are required to have at least one shareholder. The shareholder can be local or foreign person who is an individual or a corporation. Shareholders are essentially the owners of the Company. A shareholder can either be or not be appointed as a Director of the Company.

For shareholders who are directors of the company, you will be essentially the owner and management figure of the company. Your dual role means that you will need to fulfill all aspects of the Act that is required of in your capacity as director as well as shareholder of the Company.

For shareholders who are not directors, you will simply be an owner of the company who is not involved in the management of the Company. In this scenario, management decisions and statutory requirements that are placed on Directors of a company will be undertaken by a separate individual. Your control over the company operations will simply be via your decision to appoint the right person to lead the Company.

A single shareholder-director company is essentially a sole proprietorship that enjoys the benefits of a private limited company, but yet governed by the legislative requirements of the Companies Act. You will be solely responsible for all company matters as well as the sole beneficiary of all the rewards generated by the Company. Companies with 2 or more shareholders implies a co-ownership structure. Some ownership structures will consist of equal shareholders, meaning that all participants are equally entitled to the dividends declared and have an equal say on all relevant company matters.

In some arrangements, ownership may not be equal, with one shareholder being the holder of a majority shareholdings. In this arrangement, the major shareholder will have a bigger decision right as well as a larger dividend entitlement over the other shareholders.

The Shareholder Decision System

Shareholders make decisions that affects the company by way of the passing of members’ resolutions. Matters which require shareholder decisions are typically set out in the Constitution of the Company.

There are 2 types of Members’ Resolutions – Ordinary Resolution and Special Resolution. Ordinary Resolutions require a simple majority of over 50% of votes cast by members entitled to vote. For Special Resolutions, a minimum of 75% majority has to be achieved in order to pass the said Special Resolution. This 75% majority rule can be increased to a greater majority if explicitly provided for in the Articles of your Company.

Examples of Matters passed by way of Ordinary Resolutions include:

- Declaring a dividend

- Consideration of the accounts, balance-sheets, and the report of the directors and auditors

- Election of directors in the place of those retiring

- Appointment and fixing of the remuneration of the auditors

Examples of Matters passed by way of Special Resolutions include:

- Alteration of Object Clauses in Memorandum

- Alteration of Articles or Constitution

- Change in company name

- Reduction of share capital

- Voluntary winding up

- Removal of liquidator in a voluntary winding up

Statutory and Constitutional Framework

A Company operates within a defined statutory and constitutional framework. The statutory sphere is legislated under Chapter 50, Companies Act of Singapore, which lays the common foundation for all companies to work upon. The Constitution of the Company forms the constitutional framework in which the individual company will operate from within.

In principle, the Constitution is derived from the Companies Act and should not include clauses that contravene or cause to be in contrary to the legislative rulings. In any event where the Constitution is found to be contradictory of the Companies Act, the Act will and should be followed.

The Constitution typically provides a clearer directions for directors and/or shareholders for key company matters such as:

- Share related matters including issuance, variation, calls, transfers, transmission, forfeiture and alteration

- Matters relating to General Meetings and the Proceedings

- Appointment and Removal of Directors

- Powers, duties and proceedings of Directors

- Appointment and removal of Secretary

- Custody and Use of the Common Seal

- Matters relating to Company Accounts, Dividends and Reserves

- Quorum applicable for general meetings of shareholders

- Quorum applicable for transactions of business by directors to take place

NEXT ARTICLE

Read more on The Private Limited Exempt Company Part II – Annual Compliance, Tax Benefits & Regulations