Do businesses have to choose between accounting and bookkeeping services Singapore?

Businesses in Singapore do not necessarily have to choose between accounting and bookkeeping services. Even if these services are different from each other, they are most of the time interrelated, and the same service provider can provide them. It is only right to find a reliable partner when outsourcing business solutions services.

In this article, we will differentiate accounting and bookkeeping services Singapore and break down both services’ business benefits. Learn more if you continue reading below!

Accounting vs. Bookkeeping Services

-

What You Need to Know About Bookkeeping Services

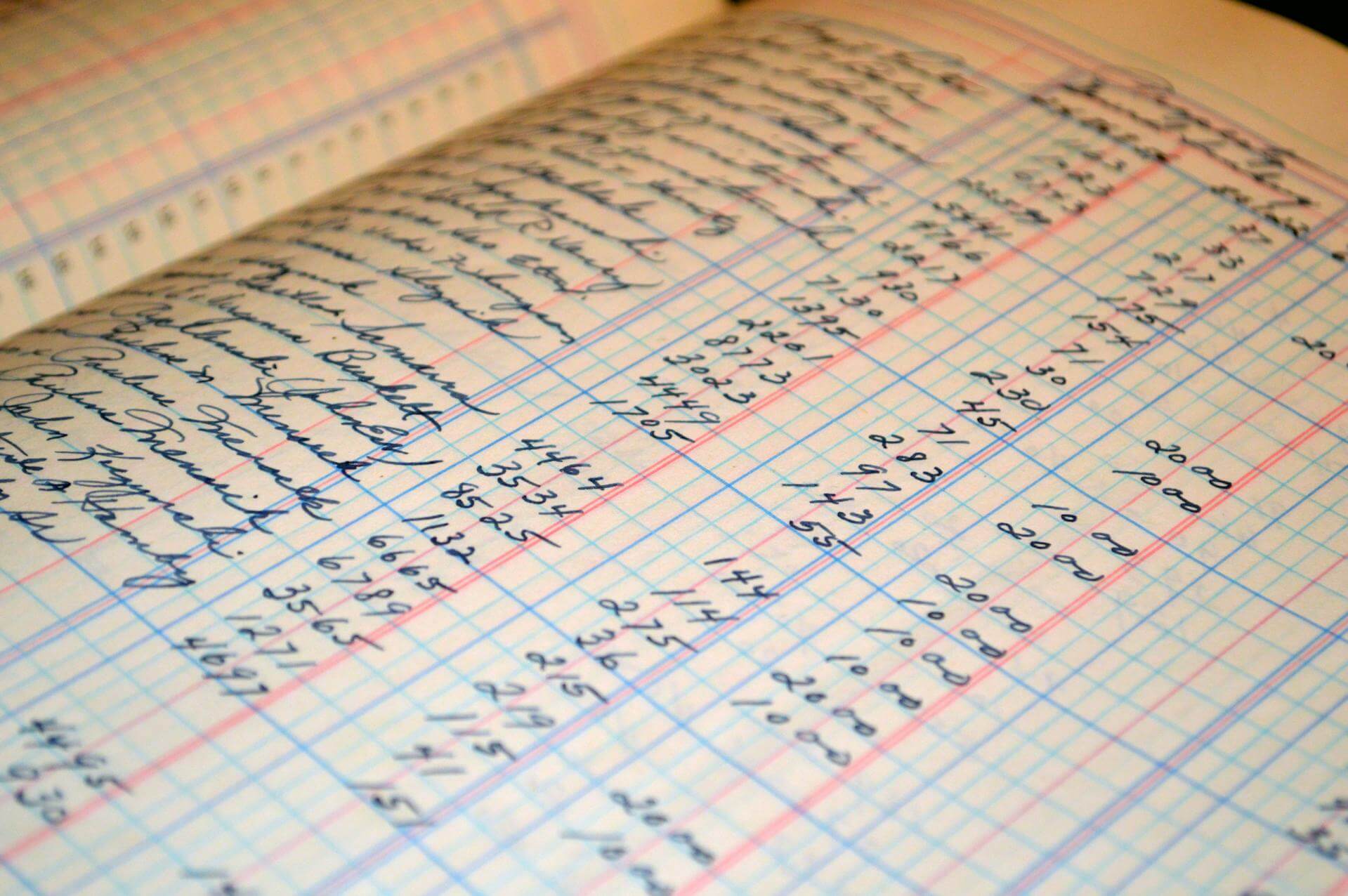

Bookkeeping is the fundamental process of recording all the financial transactions of a business or organisation, whether a small enterprise or a large corporation. The transactions recorded in bookkeeping include every financial activity the business undertakes, such as sales, purchases, receipts, and payments.

Bookkeeping aims to ensure that all financial records are maintained and updated accurately and in a timely manner. Maintaining accurate and up-to-date financial records is important because they form the basis of financial reporting and analysis. Only accurate or complete financial records can lead to correct financial reports, which can ultimately impact the decision-making process of the business.

Moreover, bookkeeping services may include tasks such as maintaining a general ledger, which is a record of all financial transactions, including categorised transactions into appropriate accounts, reconciled bank statements to ensure that the transactions recorded in the ledger match with bank records, and produced financial reports, like income statements and balance sheets.

Bookkeeping also involves ensuring compliance with various financial regulations and tax laws. This includes maintaining records of sales and purchases, tracking expenses and income, and ensuring that all financial records are appropriately categorised and reported.

-

All About Accounting Services in Singapore

While bookkeeping focuses on recording and categorising financial transactions, accounting involves using that financial data to analyse and interpret a company’s financial performance. Accounting services help businesses make informed decisions by providing an accurate and comprehensive picture of their financial situation.

One of the key tasks of accounting is to prepare financial statements, such as balance sheets, income statements, and cash flow statements. These statements provide a summary of a company’s financial activities. They are used to assess the financial health of the business.

Another vital task of accounting is analysing financial ratios. Financial ratios are used to compare different aspects of a company’s financial performance, such as profitability, liquidity, and solvency. By analysing financial ratios, accountants can identify areas where a company may be underperforming and recommend improvement.

Accounting also plays a crucial role in tax compliance. Accountants can help businesses prepare and file their tax returns, ensuring they comply with tax laws and regulations. They can also provide tax planning advice, assisting businesses in minimising their tax liability and maximising their tax savings.

Furthermore, accounting services may include budgeting, forecasting, and financial analysis. These services help businesses plan for the future and make strategic decisions based on their financial situation.

Why Choose When You Can Do Both?

Accurate and up-to-date financial records are critical for effective financial management and decision-making. Proper bookkeeping makes producing factual financial statements or conducting meaningful financial analyses possible.

Because of the close relationship between bookkeeping and accounting, many businesses outsource services in Singapore to a single provider. This can be a cost-effective and convenient way to ensure that all financial activities are properly recorded, analysed, and reported.

However, some businesses may separate accounting and bookkeeping services in Singapore and work with different providers. For example, a business may choose to outsource bookkeeping to a specialised bookkeeping firm and accounting to a separate accounting firm. This may be beneficial if the business requires more specialised accounting services, such as tax planning or financial analysis.

Deciding Whether to Outsource Bookkeeping and Accounting to a Single Provider or Not

Businesses should consider their specific needs and preferences when deciding whether to outsource accounting and bookkeeping services to a single provider or separate them into two different service providers.

Outsourcing both services to a single provider can be cost-effective and convenient. Businesses can benefit from streamlined communication and more efficient workflow by working with a single provider. In addition, a single provider may offer a more comprehensive suite of services, including bookkeeping, accounting, tax preparation, and financial planning.

However, there may be better options than outsourcing to a single provider for some businesses. Suppose a business has more specialised accounting needs. In that case, working with a different accounting firm that can provide more advanced services, such as financial analysis, forecasting, or tax planning, may be beneficial. Working with multiple service providers can also cause redundancies and reduce the risk of a single point of failure.

In evaluating potential service providers, carefully considering their qualifications, experience, and reputation is important. Look for providers with a track record of delivering high-quality services to businesses in your industry. Consider their pricing, as well as their availability and responsiveness to your needs. Finally, take the time to review contracts and service level agreements to ensure that the provider can meet your specific requirements.

Ultimately, outsourcing accounting and bookkeeping services should be based on thoroughly analysing your business needs and evaluating potential service providers. With the right partner, outsourcing these services can help businesses save time, reduce costs, and improve their financial management capabilities.

Consult ContactOne Now to Help You Make Sound Decisions

Are you looking for reliable and professional accounting and bookkeeping services in Singapore? Partner with ContactOne. Our experienced team of accounting professionals can help you manage your financial records, prepare financial statements, and provide valuable insights into your business’s financial performance. Contact us today to learn more about our services and how we can help your business succeed.

Call +65 6333 0633 and +65 8666 3633 or visit our website. Grab this chance to learn more about us and what we do. We have a bunch of services in store to assist you in growing and managing your business. With the right people and strategies, you can stand out in a market full of competent businesses like Singapore.