Introduction to FINANCIAL STATEMENTS

In this article, you will learn what are Financial Statements, and a brief introduction to the compilation process.

Types of Financial Statements

There are 2 types of financial statements – An audited financial statements and an unaudited financial statements.

For exempt private limited companies / small companies eligible for audit exemption, the accounts may be presented as unaudited accounts. For exempt private limited companies with annual turnover exceeding S$5M and private limited companies which are not exempt, the accounts must be audited (unless the company is entirely dormant for the financial period).

Components of Financial Statements

The financial statements are made up of several key sections which include:

- Directors’ Report

- Statement by Directors

- Statement by Auditors (for audited accounts only)

- Statement of Financial Position (Balance Sheet)

- Statement of Profit and Loss

- Statement of Equity

- Statement of Cashflow

- Notes to Financial Statements (Disclosure notes)

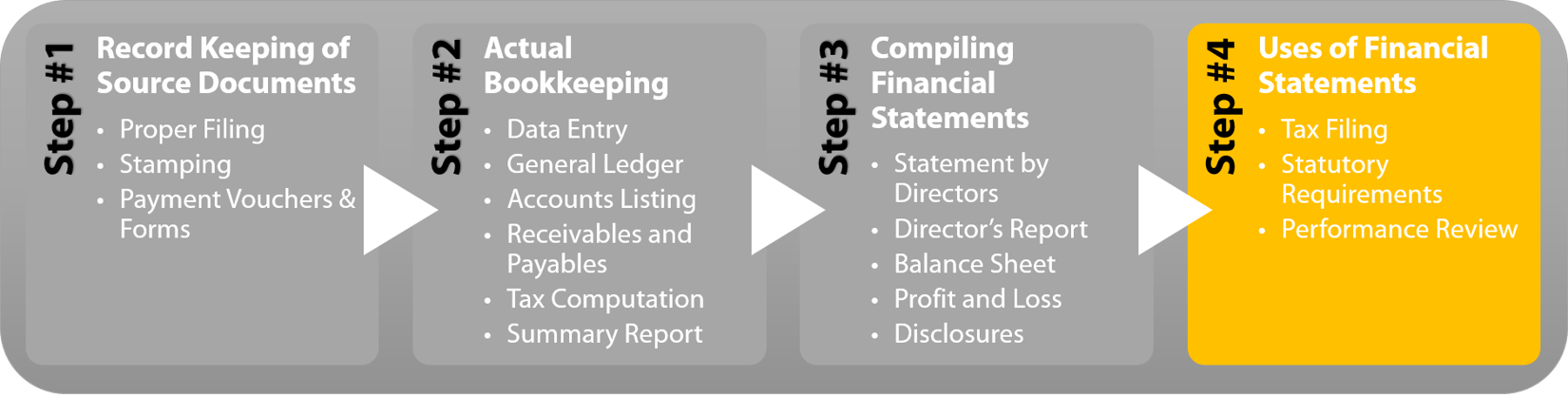

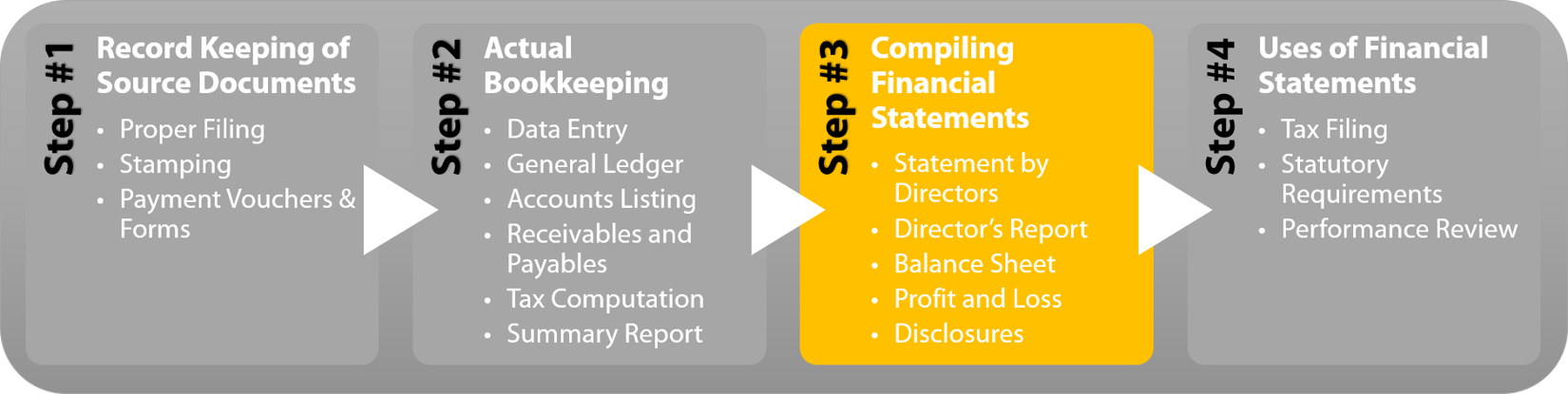

How to Compile a Set of Financial Statements

Each set of accounts is often unique and non-duplicable. Financial Statements are typically prepared by trained accountants who understand the requirements of coming up with a proper set of accounts. It is highly probable that a non-accounts trained individual may struggle to come up with a proper set of accounts, or even totally get it wrong. Our recommendation is always to engage someone who is capable of helping you get the compilation right with minimal fuss.

In order to effectively compile a set of financial statements, you will need to, at the minimum, have the following information on hand:

- Finalized General Ledger and Management accounts for the current year

- Prior year Financial Statements

- Corporate tax transactions made in the current year

- Fixed Asset Listing and any other supporting information you think may be required for the disclosure notes

<

Why Prepare Financial Statements when management accounts will do just fine?

You need to prepare financial statements simply because

1. It is required by the law to do so. The Companies Act states in S201 that the directors of the company need to prepare the accounts that complies with the “Accounting Standards”. Accounting Standards is interpreted in the Act as “made or formulated by the Accounting Standards Council under Part III of the Accounting Standards Act 2007”. Therefore, the Accounts mentioned in the Act means Accounts prepared in accordance to the Financial Reporting Standards of Singapore, that is, the Financial Statements.

2. IRAS requires you to prepare financial statements and tax computation for submission of corporate tax every year. In recent years, you do not need to submit your financial statements to IRAS if your Company is eligible to file for Form C-S filing. However IRAS has explicitly mentioned that you will still be required to continue to maintain your accounting records and tax computation even if you need not submit them together with the Form C-S.

3. If your company is not exempt, or is exempt but insolvent, you will need to submit your financial statements to ACRA during the Annual Return filing period.

4. Financial statements are in essence, a report card of the financial performance of the company and the information presented will be extremely valuable to the owners of the Company, as well as directors of the company, when assessing the future plans of the Company.

5. Whenever you intend to sell shares of your company to another investor, stamp duties need to be paid and a part of the stamp duty computation requires the use of financial statements to derive the net asset value of the Company.

6. If you have taken up business or property loan, a copy of your financial statements may be required in your refinancing procedures.