Before we start…

For the purpose of the discussion in this article, it is important to note some of the terminologies used for GST matter:

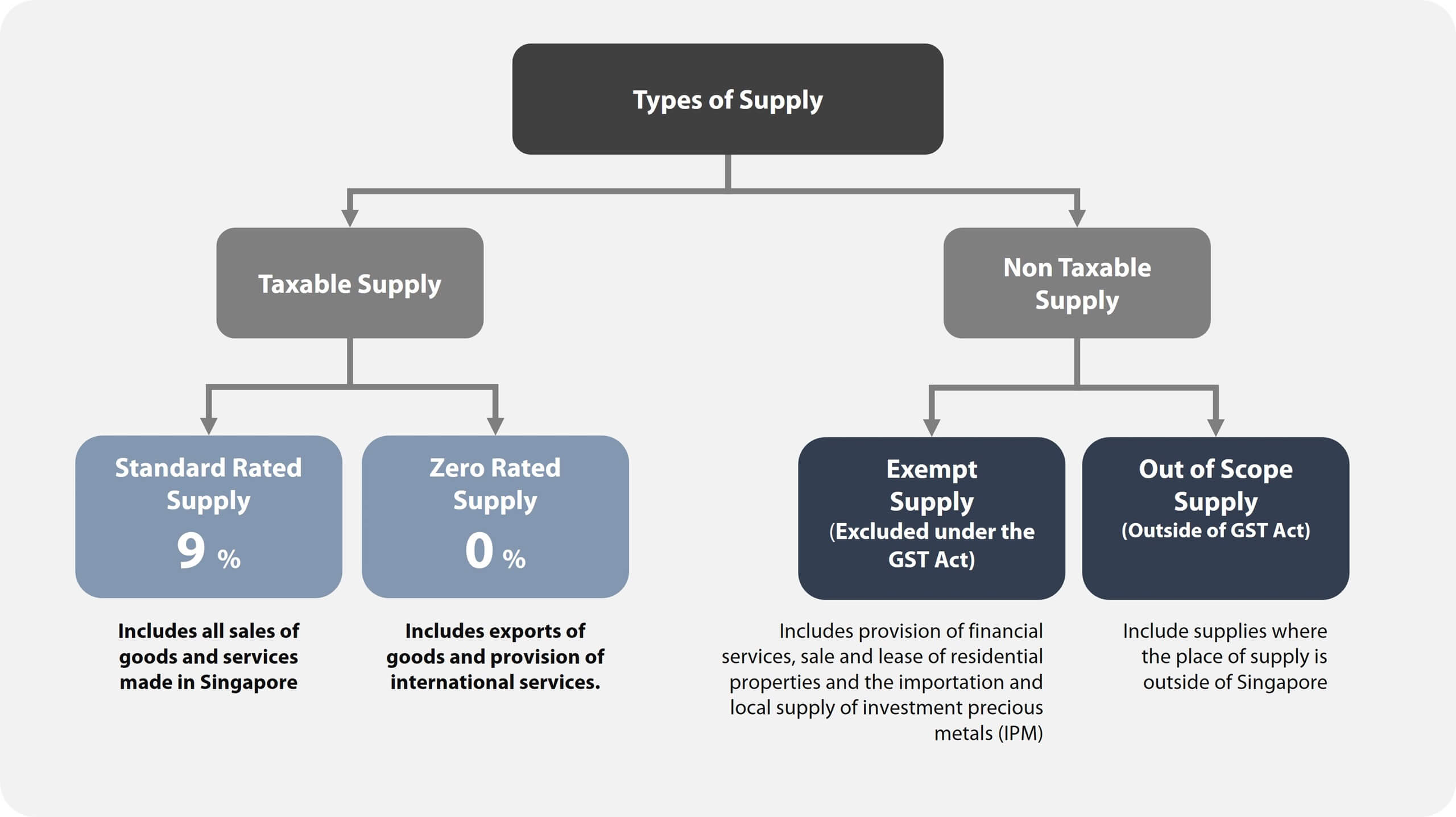

“Taxable supplies” refer to local sales of goods and services, export sales and provision of international services. However, the following are specifically excluded:

- Sales and leases of residential property (exempt supplies)

- Supplies of financial services (exempt supplies)

- Out-of-scope supplies

“Out-of-scope supplies” refer to sales which the goods did not arrive in Singapore as well as goods in transit. For example, a sale where the goods are delivered directly (back-to-back) from China to India is an out-of-scope supply.

Types of Supplies – there are 4 types of supplies which can be classified into Taxable Supply and Non Taxable Supply.

“Taxable turnover” refers to the total value of all taxable supplies made in Singapore in the course of business.

“Input Tax” refers to the GST paid on purchases and expenses for the GST registered business.

“Output Tax” refers to GST collected from customers by a GST registered business.

Do I Need to Register?

A company is required to register for GST on a compulsory basis if

- Your taxable turnover for the past 4 quarters is more than $1M and you are not certain that your turnover will not exceed $1M in the next 12 months; or

- You can reasonably expect your taxable turnover to exceed $1M in the next 12 months.

If you are a sole proprietor, the turnover will be computed based on the combine turnover of all your sole proprietorship businesses plus any income derive from your trade, profession or vocation.

If you are in a partnership, the turnover will be computed based on the combined turnover of all partnerships with the same composition of partners.

You will need to apply for GST registration within 30 days from the date that your registration liabilities arise.

A company can still register for GST on a voluntary basis even if the business turnover is below $1M. For such companies, it is wise to perform a cost-benefit analysis on the impact GST registration has on your business and reporting process. You may consider the factors explained below before making a decision as once registered, you will need to be registered for a minimum period of 2 years.

Factors to Consider when deciding if you should Register Voluntarily

PROPER BOOKKEEPING PROCESS IN PLACE TO ENSURE TIMELINESS OF GST RETURN FILING

Being GST registered comes with added commitments and administrative costs in managing the GST filing as well as ensuring your bookkeeping and documentation processes are GST compliant. The most important thing is to ensure you have the capability to file for the GST Returns on time every quarter (or six months). Later filing will result in penalties and fines as well as undue stress and resources being diverted from business development to keeping your returns to date.

CASHFLOW MANAGEMENT

There are some businesses that offer a longer credit term due to the nature of the industry. As GST on your sales is computed based on the earlier date of your invoice date or receipt date, you may need to fork out funds of your own to settle the GST payments before receiving the sales proceeds from your customers at a later date. As such it is extremely important for you to assess if your Company has the cashflow capability to go for GST registration.

OPEN TO GST AUDIT

Being GST registered means that from time to time, you may be subjected to audit by IRAS relating to your GST transactions. In some audit processes, your suppliers and customers may be contacted by IRAS to furnish records or confirmations to validate your GST filing accuracies.

ACCOUNT FOR GST ON ASSETS UPON GST DE-REGISTRATION

In the event that your GST registration is cancelled, you need to account for GST on business assets held on the last day of registration if GST was previously claimed on these purchases. This is applicable if the total market value of these assets exceeds $10,000.

ASSESSING IF YOUR SUPPLIERS AND CUSTOMERS ARE GST REGISTERED

In general, if your suppliers are mostly GST registered, it may make financial sense to register for GST to reduce your actual cost of goods or services (by 9% from 2024 onwards), provided customers are indifferent to you charging them GST in return. In some industries, both suppliers and customers are GST registered, which means that you should have the greatest incentives to register for GST with affecting your business performance.

In another scenario, you may be operating an export business. If you import goods into Singapore before exporting out to other countries, or you purchase goods from GST suppliers to export out, it makes perfect sense to register for GST as you will most likely save on the Import GST or GST charged to you by your suppliers.

In the last scenario, you may have several GST registered suppliers, but your customers are retail consumers or price sensitive clients in a competitive market, you may have to consider thoroughly if GST registration will not impact your business significantly. Absorbing the GST on behalf of your customer will reduce your profit, while passing on the GST to your customer may affect the competitiveness of your goods and services in the market.

COMMERCIAL PROPERTY HOLDING COMPANIES

For most commercial property holding companies, registering for GST is usually a common practice for the business owners as the amount of GST paid to developers may be fairly high. By registering for GST, the company will be able to reduce the overall purchase price of the property as the GST paid out can be claimed from IRAS, subject to the fulfilment of several criteria.

ONLINE BUSINESSES

Some online businesses may wish to register for GST to reduce their cost of goods or services. One point to take note would be the need for your online portal to have the capability to distinguish Singapore online sales from foreign online sales.

MINIMUM REGISTRATION PERIOD

You have to be pretty sure of what you are heading into with GST registration as once registered voluntarily, you will need to be GST registered for a minimum period of 2 years.

CONCLUSION

Deciding if you should register for GST voluntarily is a management decision which, with proper and sound planning, may be seamlessly integrated into your business processes. Bad planning or a lack of planning can result in unwanted troubles and unnecessary use of valuable resources to make right the GST returns.

A reminder from us again, if you can foresee that your company turnover will be reaching S$1M soon, it is wise to start planning early as businesses that require compulsory GST registration do not have the luxury of time to gradually implement GST into their company processes. They only have 30 days or so to do that.